- Deep Learning: LSTM (Long Short-Term Memory) neural networks will analyze time series data to identify complex market patterns and trends.

- Reinforcement Learning: Bots will adapt autonomously to market changes, minimizing losses and boosting profits—especially useful for volatile assets like cryptocurrencies.

- Big Data Integration: AI will process not just price data, but also news feeds, social media, and economic reports, increasing forecast accuracy.

Automated trading is evolving rapidly, and in the coming years, technologies like artificial intelligence, quantum computing, and blockchain will dramatically reshape how trading is conducted in financial markets. In this article, we explore the key directions of automated trading development from 2025 to 2030 and their impact on platforms such as Pocket Option.

The Future of Automated Trading

AI and Neural Networks: Forecasts for 2025–2030

Artificial Intelligence (AI) and neural networks are already widely used in automated trading, and their influence will only grow. Experts predict that by 2030, over 70% of financial market trading decisions will be made using AI. This means trading bots will become more accurate, adaptive, and capable of generating profits for traders with minimal effort.

Current Capabilities

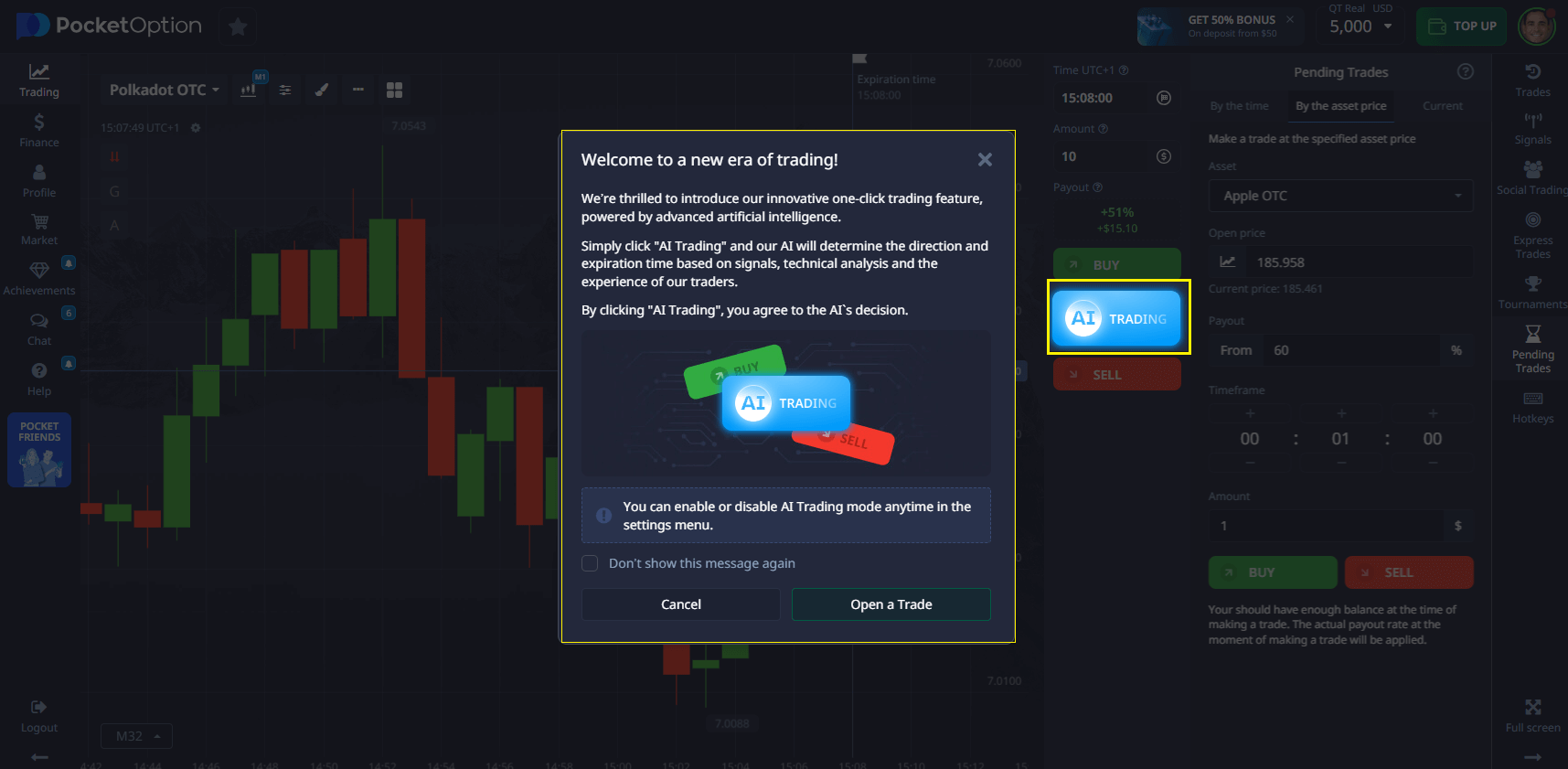

As of 2025, trading bots like Pocket Option’s AI Trading use machine learning to analyze market data and generate signals. These systems are trained on historical data and can predict price movements with up to 89% accuracy (according to Pocket Option’s internal research).

Forecasts for 2025–2030

Use Case

By 2030, bots will be able to analyze news articles in real time using Natural Language Processing (NLP) and adjust strategies based on market sentiment.

Recommendation: Traders should monitor AI developments and start integrating them into their strategies. For example, bots using TensorFlow or PyTorch can support custom solutions.

Quantum Algorithms (Test Cases from IBM and Google)

Quantum computing is set to revolutionize automated trading. As of 2025, companies like IBM and Google are actively developing quantum algorithms for financial markets, opening new opportunities for traders.

Current Developments

- IBM Quantum: Developing algorithms for portfolio optimization and price forecasting that can be integrated into trading bots.

- Google Quantum AI: Accelerates machine learning processes, enhancing big data analysis for trading.

Forecasts for 2025–2030

- Strategy Optimization: Quantum algorithms will deliver optimal trading decisions in fractions of a second—beyond the capabilities of classical computers.

- Risk Management: Simulating thousands of market scenarios will help traders better manage risks.

- Accessibility: By 2030, cloud-based quantum platforms like IBM Quantum Experience will become available to retail traders.

Use Case

A trader could use a quantum algorithm on Pocket Option to optimize their portfolio, minimizing risk and maximizing returns.

Recommendation: Follow the evolution of quantum technologies and prepare to integrate them into your trading systems—it could become your competitive edge.

Decentralized Blockchain Bots (Solana, Ethereum)

Blockchain technologies such as Solana and Ethereum provide the foundation for decentralized trading bots. By 2025, these solutions are gaining popularity due to their transparency, security, and autonomy.

Advantages of Decentralized Bots

- Transparency: All transactions are recorded on the blockchain, preventing manipulation.

- Security: Smart contracts protect trader data and funds.

- Autonomy: Bots operate without intermediaries, reducing fees and risks.

Example Platforms

- Solana: High speed and low fees make it ideal for high-frequency trading.

- Ethereum: Popular for creating decentralized apps (dApps), including trading bots, though it has higher fees.

Forecasts for 2025–2030

By 2030, about 30% of trading bots will run on blockchain, ensuring censorship resistance and protection against manipulation. Integration with decentralized exchanges (DEXs) will allow bots to trade across multiple platforms simultaneously.

Use Case

A trader can use a bot on Solana to automatically trade cryptocurrencies on Pocket Option, benefiting from low fees and fast execution.

Recommendation: Learn about decentralized bots, especially if you’re working with crypto. They offer enhanced security and transparency for your trading operations.

Conclusion

The future of automated trading on Pocket Option is closely tied to the growth of AI, quantum computing, and blockchain technologies. Between 2025 and 2030, traders will gain access to more accurate, adaptive, and secure tools, opening new income opportunities. To remain competitive, stay informed about tech trends and integrate them into your trading strategies.