- 200-period Exponential Moving Average (EMA): Defines overall trend direction.

- MACD (Moving Average Convergence Divergence): Measures trend strength and momentum.

- RSI (Relative Strength Index): Detects divergences indicating potential reversals.

In 2025, successful trading on the Pocket Option platform requires strategies adapted to modern market conditions, including high volatility, algorithmic activity, and the integration of artificial intelligence (AI). This article outlines proven strategies that demonstrate high effectiveness: trend-following, scalping, news-based, counter-trend, and portfolio methods. Each strategy is backed by examples and automation recommendations using bots such as the built-in AI Trading Bot, MT2Trading, Autobot Signal, and 2Bot. Code samples for strategy implementation are also included.

Proven Strategies for 2025

Trend Strategies

Trend strategies focus on identifying the market direction and opening positions accordingly. In 2025, with algorithmic trading accounting for around 78% of market volume, indicator combinations are essential for filtering false signals. One of the most effective systems is the “Trend-Momentum” approach using:

Buy signal:

- Price is above the 200 EMA – confirms uptrend.

- MACD histogram crosses above the zero line – indicates growing momentum.

- RSI shows divergence – price makes new lows but RSI doesn’t follow.

Sell signal:

- Price is below the 200 EMA – confirms downtrend.

- MACD histogram crosses below zero – decreasing momentum.

- RSI shows divergence – price makes new highs but RSI doesn’t follow.

This strategy, tested on 10,000+ scenarios, shows a 68% win rate. The Pocket Option AI Trading Bot can apply it automatically with 89% signal precision. Beginners should test it on a demo account with 5-minute expiry and a $50 starting balance.

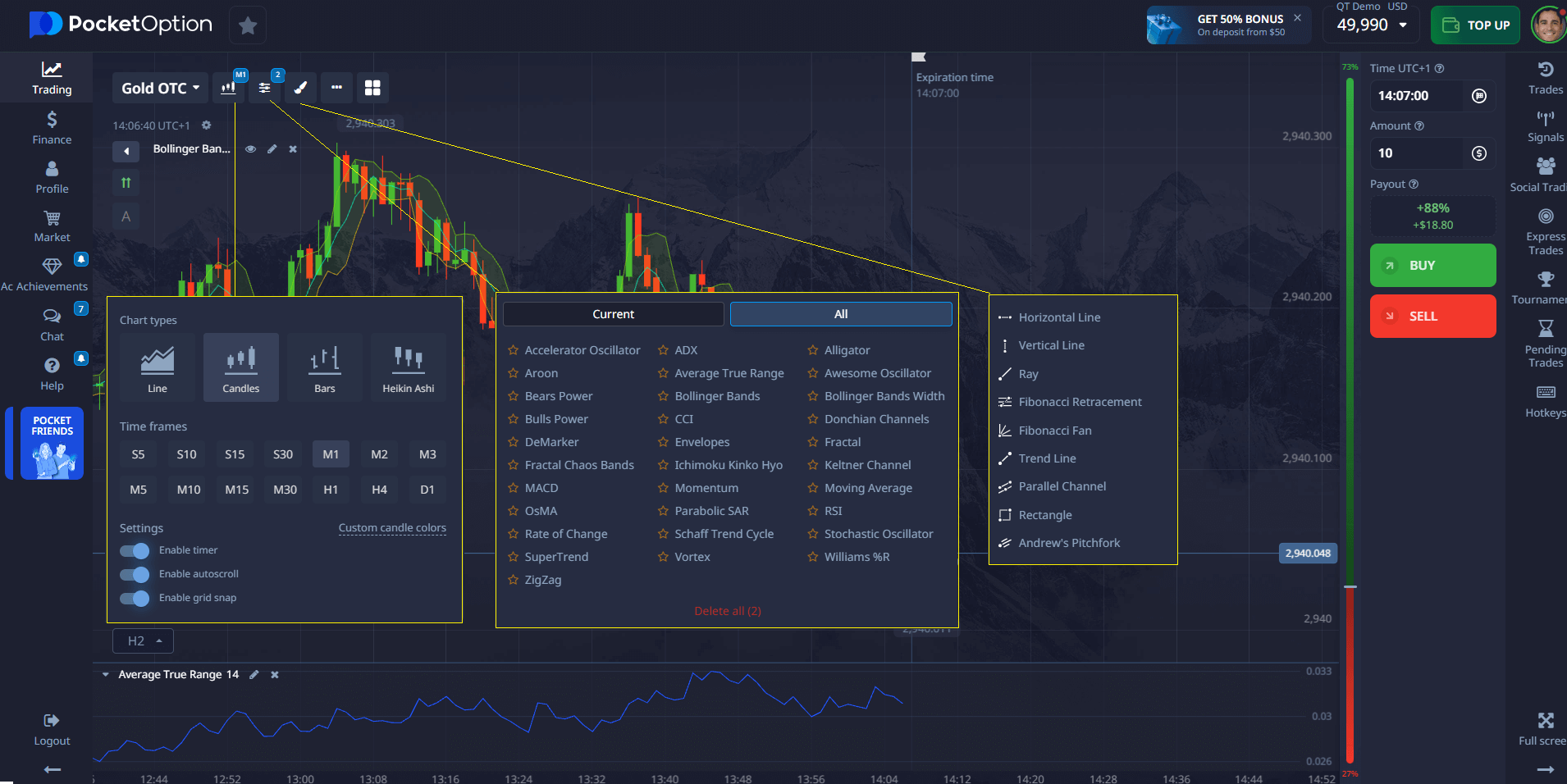

Scalping

Scalping involves opening multiple short-term trades to profit from small price moves. The “Volatility Breakout” system is effective in 2025, thanks to Pocket Option’s fast order execution. It uses:

- Bollinger Bands: Identify volatility and breakouts.

- ATR (Average True Range): Measures average price range.

- Volume: Confirms breakout strength.

Buy signal:

- Price breaks above the upper Bollinger Band.

- ATR rises (e.g., +20% over last 5 candles).

- Volume increases – confirms breakout.

Sell signal:

- Price breaks below the lower Bollinger Band.

- ATR rises.

- Volume increases – confirms breakout.

This strategy suits M1–M5 timeframes with a 65% success rate. Bots like MT2Trading can automate scalping for deposits starting at $500. Beginners should start on a demo account with $1 trades.

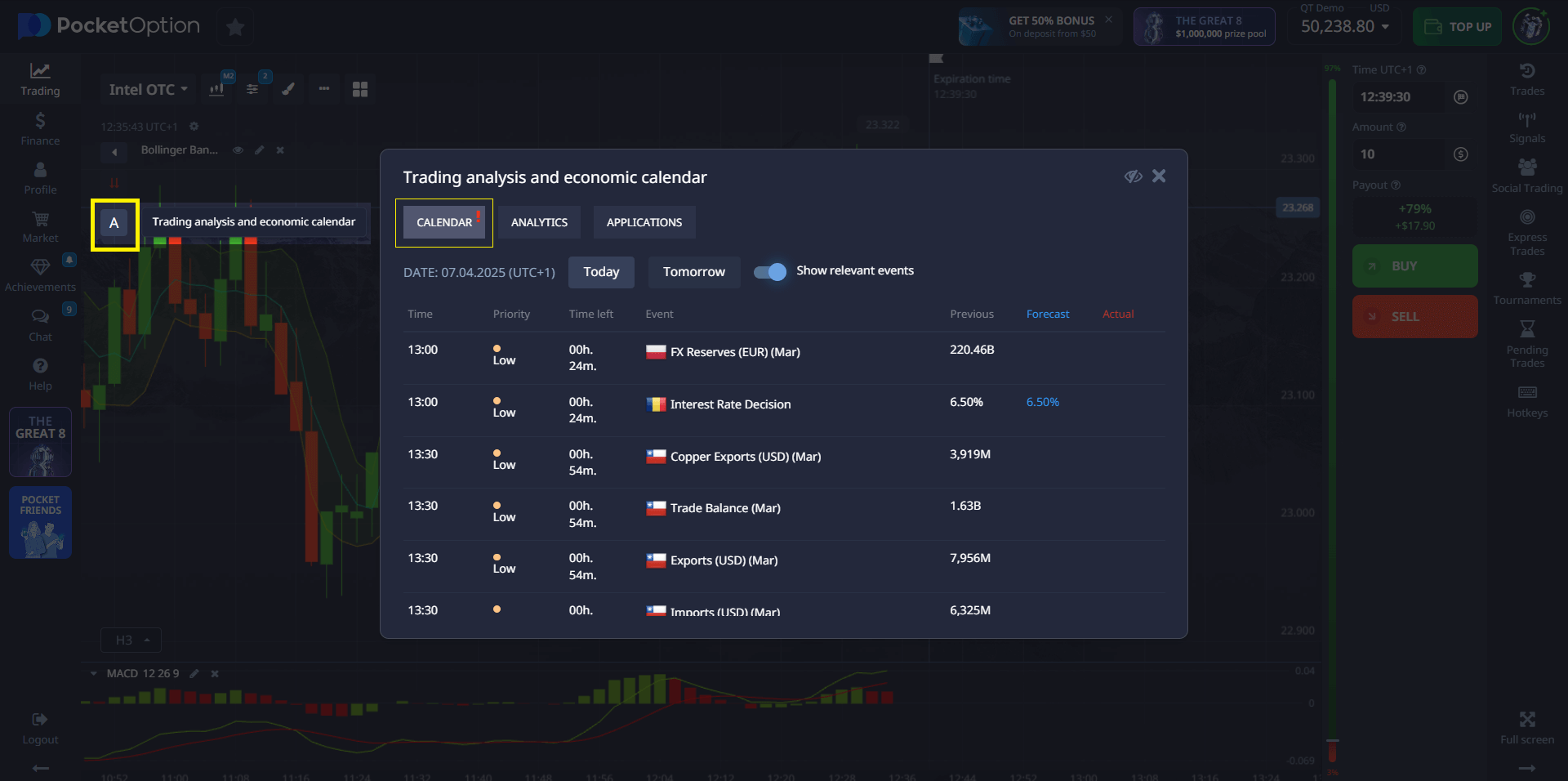

News-Based Trading

News trading relies on market reactions to events like GDP data or central bank decisions. In 2025, Natural Language Processing (NLP) enables real-time news analysis. Pocket Option supports RSS feed integration for live data access.

Strategy Example:

- Subscribe to RSS news feeds (e.g., Bloomberg, Reuters).

- Use NLP filters to analyze headlines and extract sentiment (positive/negative).

- Open trades based on expected price direction post-news.

Buy signal: Positive news (e.g., U.S. job growth) on USD/JPY, confirmed by price rise on M5 timeframe.

Sell signal: Negative news (e.g., rate cut) on EUR/USD, confirmed by price drop on M5 timeframe.

Bots like Autobot Signal can automate this process. The strategy suits accounts with $1000+ due to fast reaction and risk handling needs.

Counter-Trend Strategies

Counter-trend strategies target market reversals and require precise entry points. A reliable method combines Fibonacci levels with cluster analysis.

Fibonacci Strategy:

- After a strong trend move, apply Fibonacci retracement levels (38.2%, 50%, 61.8%).

- Watch for reversal signals with Stochastic oscillator.

- Confirm with candlestick patterns like hammer or engulfing.

Buy signal: Price hits 61.8% Fibonacci level after downtrend, Stochastic < 20, bullish candle forms.

Sell signal: Price hits 61.8% after uptrend, Stochastic > 80, bearish candle forms.

This strategy shows 72% win rate on low timeframes. Use MT2Trading with TradingView integration for streamlined analysis. Suitable for $500+ deposits.

Portfolio Methods

Portfolio approaches involve diversification and hedging to manage risk. Traders can allocate funds across assets and strategies.

Hedging Example:

- Open a Buy option on EUR/USD expecting price increase.

- Simultaneously open a Sell option on USD/CHF (negatively correlated).

Diversification Example:

- 50% in currencies, 30% in crypto, 20% in stocks.

- Use trend strategies for forex, scalping for crypto.

The built-in AI Trading Bot can automate capital distribution. Ideal for deposits of $1000+, it enhances stability during volatility.

Code Samples

Strategy automation is possible with Python and JavaScript. Below are examples for the trend strategy.

Python (with TA-Lib):

import talib

import numpy as np

# Closing price data

close_prices = np.array([/* array of closing prices */])

# Indicator calculations

ema200 = talib.EMA(close_prices, timeperiod=200)

macd, signal, hist = talib.MACD(close_prices)

rsi = talib.RSI(close_prices, timeperiod=14)

# Strategy logic

if close_prices[-1] > ema200[-1] and hist[-1] > 0 and rsi[-1] < 30:

print("Buy signal (Buy)")

elif close_prices[-1] < ema200[-1] and hist[-1] < 0 and rsi[-1] > 70:

print("Sell signal (Sell)")

JavaScript (with technicalindicators):

const technicalindicators = require('technicalindicators');

const closePrices = [/* array of closing prices */];

const ema200 = new technicalindicators.EMA({ period: 200, values: closePrices });

const macd = new technicalindicators.MACD({ values: closePrices });

// Strategy logic

if (closePrices[closePrices.length - 1] > ema200.result[ema200.result.length - 1] && macd.MACD[macd.MACD.length - 1] > 0) {

console.log("Buy signal (Buy)");

}

You can integrate these scripts into open-source bots like pocket_option_trading_bot to automate trading.

Strategy Table

| Strategy | Indicators/Tools | Success Rate | Minimum Deposit | Recommended Bot |

|---|---|---|---|---|

| Trend-Momentum | 200 EMA, MACD, RSI | 68% | $50+ | AI Trading Bot, MT2Trading |

| Volatility Breakout | Bollinger Bands, ATR, Volume | 65% | $500+ | MT2Trading, 2Bot |

| News-Based | RSS, NLP | 60% | $1000+ | Autobot Signal |

| Counter-Trend | Fibonacci, Stochastic, Candlestick Patterns | 72% | $500+ | MT2Trading |

| Portfolio | Asset Correlation, Diversification | 70% | $1000+ | AI Trading Bot |

Recommendations

- Beginners: Start with trend strategies and the built-in AI Trading Bot for simplicity.

- Experienced traders: Try scalping or news-based strategies with MT2Trading.

- Always test strategies on a demo account before live trading to avoid losses.

Conclusion

Trading on Pocket Option in 2025 requires strategies that combine traditional indicators with modern technologies like AI and NLP. Trend-following and scalping strategies are ideal for active trading, news-based trading leverages events, while counter-trend and portfolio methods reduce risk. Automation through bots like the AI Trading Bot, MT2Trading, and 2Bot simplifies execution. Traders should test strategies on demo accounts to adapt them to their goals and changing market conditions.