-

Pocket Option Mobile App

Description: The official Pocket Option app, available for Android and iOS, allows manual trading and control of the built-in AI Trading Bot.

Features:- Enable and disable the AI Trading Bot

- Adjust settings such as bet size and expiration time

- Track balance and trade history

Pros: Intuitive interface and full integration with the platform

Cons: Limited functionality with third-party bots

-

MT2Trading Mobile

Description: The mobile version of the MT2Trading platform for managing bots integrated with MetaTrader 4/5.

Features:- Start and stop bots

- Configure trading strategies and risk levels

- Real-time trade notifications

Pros: Support for complex strategies and MetaTrader compatibility

Cons: Paid subscription and complexity for beginners

-

Autobot Signal Mobile

Description: An app for managing the Autobot Signal bot, which works with TradingView and MetaTrader.

Features:- Configure trading signals and strategies

- Monitor bot performance

- Control risk and bet size

Pros: Flexibility and integration with popular platforms

Cons: Paid, with different pricing plans

-

2Bot Mobile

Description: Mobile version of the free 2Bot, available via web interface or as a Progressive Web App (PWA).

Features:- Choose trading modes (signals or strategies)

- Set up assets and expiration time

- Track trades and balance

Pros: Free and easy to use

Cons: Fewer features compared to paid alternatives

-

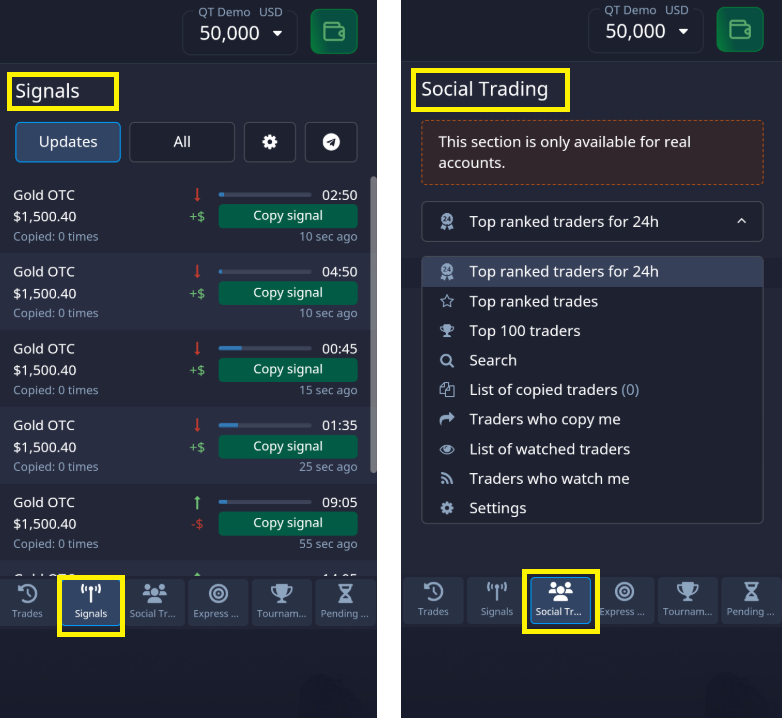

Telegram Bots

Description: Manage bots via Telegram, supported by many trading solutions.

Features:- Trade notifications

- Commands to start, stop, or change strategy

- Monitor balance and drawdown

Pros: Convenient and accessible on all devices

Cons: Requires setup and may be difficult for beginners

In 2025, mobile trading has become an essential part of trading on the Pocket Option platform, allowing traders to manage trades and bots directly from their mobile devices. This article provides an overview of the top 5 mobile apps for managing trading bots, setting up geolocation triggers, and using bots in offline mode. These tools empower traders to remain flexible, respond to market changes quickly, and trade without being tied to a desktop computer.

Mobile Trading

Top 5 Apps for Managing Bots via Mobile

In 2025, mobile apps for managing trading bots have become essential tools for traders on the Pocket Option platform. Below is a list of the top 5 apps that offer convenient and secure bot management:

Recommendation: Beginners should consider the Pocket Option Mobile App for its simplicity and built-in AI Trading Bot. Experienced traders might prefer MT2Trading Mobile or Autobot Signal Mobile for advanced strategies. Telegram bots are ideal for quick notifications and mobile control.

Setting Geolocation Triggers (Scheduled Trading)

Geolocation triggers allow bots to start or stop automatically depending on the trader’s location. In 2025, this is especially useful for travelers or those who want to trade only in specific places.

How It Works

Using apps like IFTTT (If This Then That) or Zapier, you can set triggers that activate the bot when entering a predefined geozone (e.g., “Home” or “Office”).

Example: The bot starts when the trader is at home and stops when they leave the zone.

Use Case Example

A trader sets up IFTTT so that the bot begins trading when entering the “Home” geozone and disables itself upon exit. This provides automation and safety by allowing trading only in controlled environments.

Recommendation: Use geolocation triggers to automate trading in a safe setting. It helps reduce risks and align trading with your personal schedule.

Offline Operation: Offline Mode and Local Servers

Offline bot operation allows trading to continue even without internet access — a crucial feature in regions with unstable connections. In 2025, bots support offline mode and operation via local servers.

Offline Mode

Some bots (such as open-source solutions from GitHub) can run locally.

The bot preloads market data and executes trades based on it, even if the internet goes down.

Local Servers

Using a VPS (Virtual Private Server) enables remote bot operation, allowing 24/7 trading without relying on your personal device.

VPS can be configured to auto-restart the bot during failures, increasing stability.

Use Case Example

A trader installs a bot on a VPS, which operates 24/7 and executes trades on Pocket Option. This enables trading even when the trader’s personal device is off.

Tip: Use a VPS for uninterrupted trading, especially on volatile markets like cryptocurrencies. Beginners can rent a VPS for $5–10 per month.

Recommendations

- For simplicity, use the Pocket Option Mobile App with the AI Trading Bot

- Set up Telegram bots for notifications and mobile control

- Use a VPS for 24/7 autonomous trading

With these solutions, you can stay connected to the market and manage your trades anytime, anywhere.