- Bot: MT2Trading integrated with MetaTrader 5

- Assets: Highly liquid forex pairs like EUR/USD and GBP/USD

- Timeframe: M15 (15 minutes)

- Expiration: 5 minutes

- Trade size: $10 (1% of deposit)

In this article, we explore three practical case studies that will help you understand how to use trading bots on the Pocket Option platform to achieve specific financial goals. These examples are based on real trader stories and research, highlighting both successful strategies and common beginner mistakes. You’ll learn how to configure a bot for stable income, how to avoid losses, and what lessons can be learned from others’ experiences.

Practical Case Studies

How to Earn $500 per Month with a $1000 Deposit

Goal:

Earning $500 per month with an initial deposit of $1000 is an ambitious target, implying around 50% monthly returns. With proper bot settings and strict risk control, this goal is achievable.

Strategy:

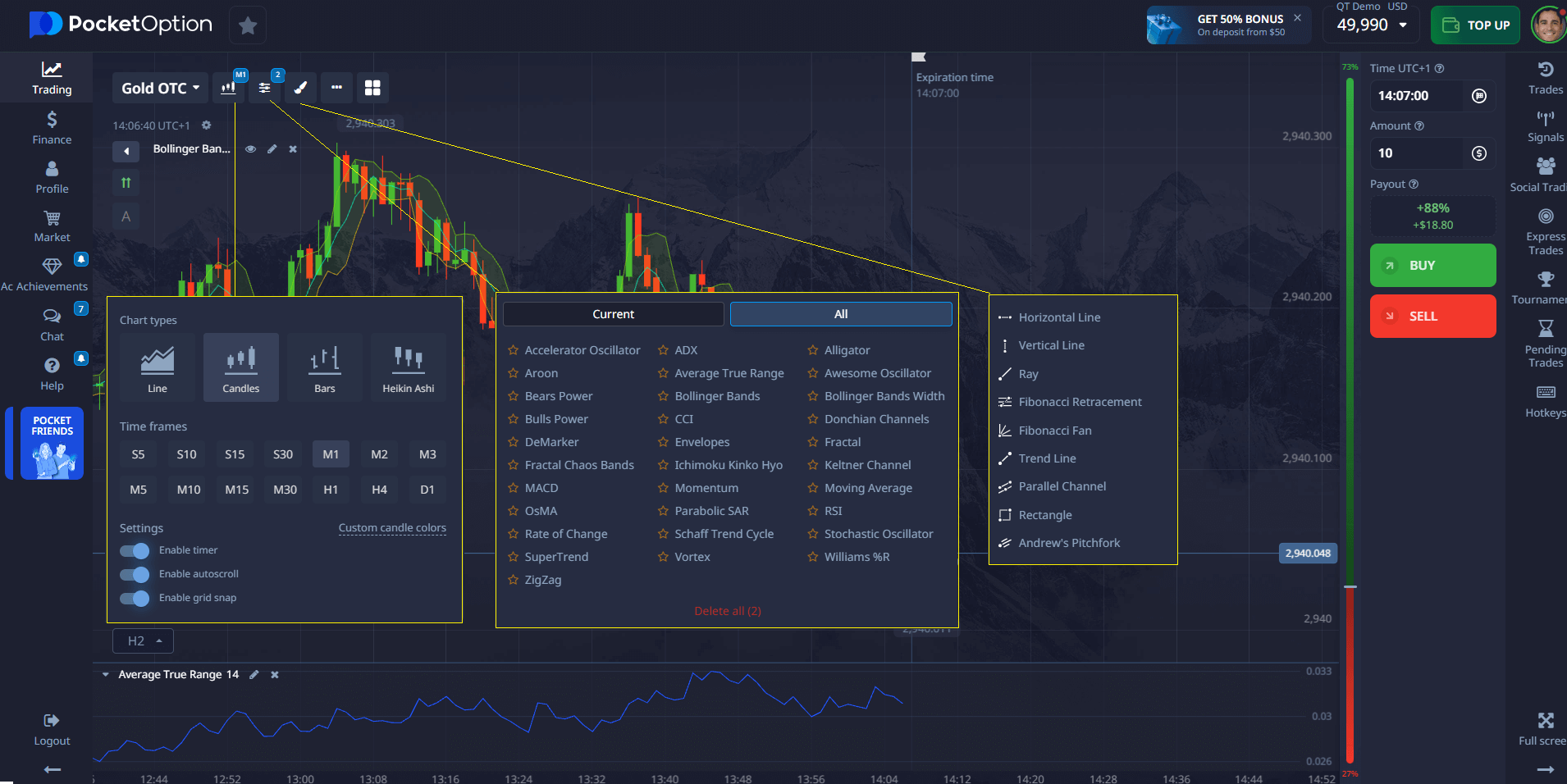

Trend-following strategy using EMA (Exponential Moving Average) and MACD (Moving Average Convergence Divergence) indicators.

Tools:

Indicator Settings:

- EMA 12 & EMA 26: Identify trend direction

- MACD (12, 26, 9): Confirms trend strength

- Buy Signal: Price above EMA 12 and EMA 26, MACD histogram positive

- Sell Signal: Price below EMA 12 and EMA 26, MACD histogram negative

Results:

- Number of trades: Around 20 per day

- Win rate: 60%

- Average daily profit: $50

- Monthly profit: $1000 (over 20 trading days)

Recommendations:

- Test the strategy on a demo account for at least 2 weeks

- Maintain risk control — no more than 1% per trade

- Regularly analyze the market and adjust settings as needed

Note:

Research shows that trend-following strategies using EMA and MACD can achieve 60–65% success on volatile markets.

Trader Story: From -80% to +220% in One Year

Story:

The trader started with a $5000 deposit but lost 80% within the first three months due to lack of strategy and emotional decisions. After reassessing their approach, they grew the remaining $1000 to $3200 in a year — a +220% return.

Initial Mistakes:

- No clear trading strategy

- Emotional trading after losses

- High risk — positions were 5–10% of deposit

Turning Point:

- Switched to demo trading to develop a strategy

- Used 2Bot with a trend-based strategy

- Reduced risk to 1% per trade

New Strategy:

- Bot: 2Bot

- Indicators: EMA 50 (for trend), RSI (to confirm overbought/oversold)

- Trade size: $50 (1% of $5000 deposit)

- Result: Steady capital growth with a maximum drawdown under 10%

Outcome:

Capital grew from $1000 to $3200 over 12 months, showing a +220% return.

Lesson:

Discipline, risk management, and testing strategies on demo accounts are the keys to successful trading.

Failure Review: 5 Fatal Mistakes by Beginners

Beginners often face losses due to common mistakes. Here are the top five and how to avoid them:

- Mistake 1: No Strategy

Issue: Random trading without a plan leads to unpredictable results and losses.

Solution: Develop and test your strategy before going live. - Mistake 2: Emotional Trading

Issue: Fear or greed causes irrational decisions, especially after losses.

Solution: Trust automation and avoid manual interference. - Mistake 3: High Risk

Issue: Risking more than 2% per trade can wipe out your deposit quickly.

Solution: Limit risk to 1–2% per trade. - Mistake 4: Ignoring Demo Accounts

Issue: Trading with real money without preparation increases loss chances.

Solution: Use a demo account for 2–4 weeks to test your strategy. - Mistake 5: Interfering with Bot

Issue: Constant setting changes or manual trade closures reduce automation effectiveness.

Solution: Set up the bot and let it run independently.

Recommendations:

- Develop and test your strategy on a demo account

- Set a fixed risk level (1–2% per trade)

- Avoid emotions and trust your bot

Conclusion

These practical case studies show that trading bots on Pocket Option can be powerful tools for achieving financial goals. Success depends on proper configuration, discipline, and risk control. Test your strategies on a demo account, follow a clear plan, and avoid typical beginner mistakes — this will help you grow capital steadily and minimize losses.